After years of record-breaking growth, signs are emerging that Nashville’s red-hot real estate market is catching its breath — and that’s good news for investors who’ve been waiting for the right moment to get in.

A bank recently assumed a finished new construction home in Green Hills, while a two-year-old home is now being marketed near cost in North Nashville, signs that the city’s red hot real estate market is cooling slightly. But this “hiccup” could spell big opportunities for savvy investors.

Rising Rates, Slower Sales — and Strategic Opportunity

For some, the appeal is price appreciation. But will values rise $15,000 next year, $30,000 in two, or $45,000 in three? Recent data shows slow growth as buyers hesitate and sellers hold firm, creating a standoff.

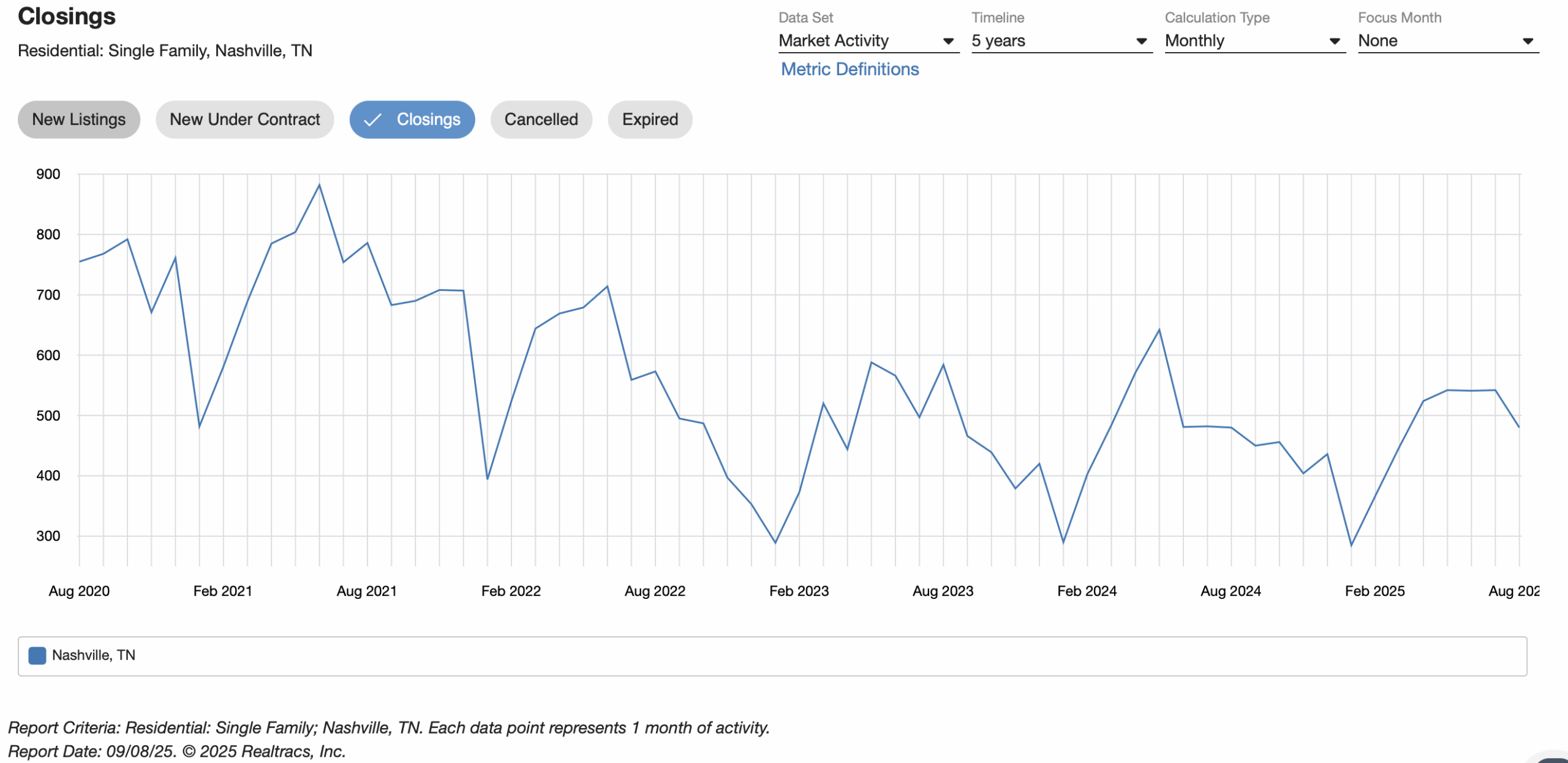

Real estate is inherently volatile: Prices climb on future optimism and drop when inventory piles up. Nashville’s 3-year slowdown in closings has hit builders and developers hard. For 15 years, they’ve flipped homes quickly using bank loans, but now unsold stock means mounting interest costs. Projects are budgeted for short holds, but prolonged delays hurt. Some pull listings for better times; others slash prices to move inventory.

After three years of rising supply, we’re seeing aggressive pricing on some recent new builds, some 20-33% below 2022 peaks in overbuilt areas. This opens doors for investors: properties yielding 7-10% gross rents and strong appreciation potential. Buy today at a discount, and a return to 2022 values could mean 50% ROI, plus ongoing cash flow from Nashville’s rental demand.

Recent Trends at a Glance

Curious how this has played out over time? Here’s a snapshot of the Nashville market over the past five years — showing both median sales prices and the number of closed transactions:

Why This Market Matters

This isn’t 2008. Nashville’s fundamentals remain strong:

- Steady population growth

- Ongoing corporate relocations

- Rental demand that continues to outpace supply

Growth persists, homes keep getting built, companies keep relocating, and the city expands. Last month, financing closed for Paramount Tower, Nashville’s future tallest skyscraper at 750 feet, a symbol of enduring momentum. The “new Nashville” blueprint is locked in, even if the path zigzags.

A Smart Time to Act

Whether you’re looking to buy and hold or purchase at a discount ahead of the next up-cycle, this market is offering a window. With properties in some areas now yielding 7–10% gross rents — and the potential for double-digit equity gains over time — investors who step in now could realize strong total returns in the years ahead.

Want tailored insights on the best rental or investment deals in the Nashville market?

📩 Reach out to our team — we’re happy to share what we’re seeing and where we believe the smart money is headed next.